Current Market Index Rates

Value

Highland Realty Capital has a strong track record structuring the best possible capital solutions for real estate clients, including:

- Permanent Loans

- Bridge Loans

- Construction Loans

- Mezzanine Financing

- Preferred Equity

- JV Equity

- Co-GP Equity

- Asset Sales

Track Record

The principals of Highland have a track record in excess of $7 billion in closed transactions involving all property types including:

- Office

- Apartments

- Retail

- Industrial

- Hospitality

- Residential Subdivisions and Condominium Developments

- Land

- Self-storage

- Manufactured Housing Communities

Featured Deals

Medical Office Building – Downtown LA

Fixed Rate Loan

78,000 SF, 8 story Medical Office building

Los Angeles, CA

Highland arranged a $14,750,000, non-recourse fixed rate loan ...

Santa Monica Medical

Permanent Loan

61,000 sf medical office building

Santa Monica, CA

Highland arranged a $47 million permanent loan with an insurance company...

Mandarin Oriental

Land Loan

1.16-Acre Hotel & Condo Development Site

Honolulu, HI

Highland Realty Capital has secured a $44.0mm land loan to refinance...

The Bond Apartments

Perm Loan

139-Unit Multi-Family

Redmond, WA

Highland successfully arranged permanent financing for the acquisition of...

Scotia Apartments

Bridge Loan

55-Unit Multi-Family

San Jose, CA

During the challenging capital environment with lenders exiting the market...

48 East Avenue

Construction Loan

249-Unit Condominium Development

Rainey District, Austin, TX

Highland arranged the $87.9MM non-recourse construction loan for the 30-story...

Ruckus

Bridge Loan

976-Bed Student Housing

Pullman, WA

Highland procured a $40.95mm bridge loan to refinance and renovate...

LA County Industrial

Perm Loan

400,000 SF Class A Industrial

Los Angeles, CA

Highland secured a $63mm fixed rate permanent loan for...

Harrah’s Hotel and Casino

Bridge Loan

Mixed-Use Redevelopment

Reno, NV

Highland arranged a $26.0mm bridge loan for the acquisition of...

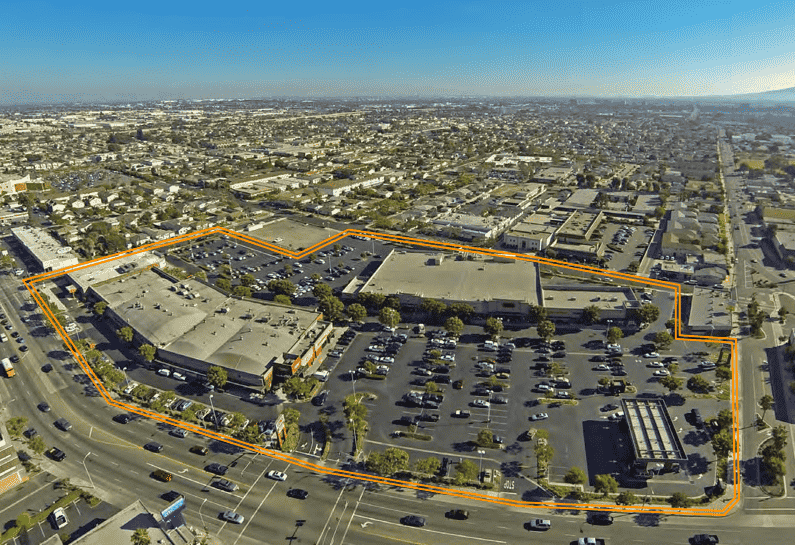

Gardena Neighborhood Retail Center

Perm Loan

128,000 SF Shopping Center

Gardena, CA

Highland placed a $23,000,000 low leverage CMBS perm loan on a...

The Union – Oakland, CA

JV Equity & Construction Loan

110-Unit Multi-Family

Oakland, CA

Highland Realty Capital successful arranged full capitalization of...

InterContinental The Clement Hotel

208-Key Full-Service Hotel

Monterey, CA

The property was originally slated to carry a 4.5-star flag, but because...

RECA Founding Member

The Real Estate Capital Alliance (RECA) was formed by a group of boutique real estate capital advisory firms with offices in major metropolitan markets and clients across the U.S. Collectively, the group consisting of 16 member firms and more than 80 originators arranged over $4.0 billion in 2020. The primary purpose of RECA is to leverage the relationships, experience and daily interactions in the capital markets of a larger group of advisors in order to not only ensure that the clients of each company are securing access to the best possible capital in the market, but also to build stronger relationships with the capital providers, increasing the certainty of execution.